The value of pensions and investments can fall as well as rise. You may get back less than you invested.

Transferring out of a Final Salary scheme is unlikely to be in the best interests of most people.

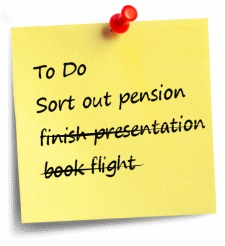

The end of the tax year is traditionally the time of the year when pension holders look to review their financial arrangements.

For many, that’s easier said than done. If you’ve contributed to a number of workplace pensions over the years with a range of employers, the likelihood is that you would have accumulated a growing pile of statements and letters from your various providers. The prospect of wading through that paperwork can be daunting.

But do you know how well these pensions are performing or the risks associated with your investments? Your money could be sitting in a poorly-performing fund, generating low levels of growth? Scrutinising your pensions now could leave you with a greater sum when it comes to retirement, and potentially even influence your retirement date.

Before we go any further, it’s important to remember that transferring your pensions into one scheme is not for everyone. Each individual has different circumstances. The road ahead will depend on the types of pension you have and the time left until you retire. You should take advice from a financial adviser if you’re unsure what to do.

If you’re looking for advice on what to do with an existing fund, our team can help you find a suitable plan that matches your objectives. For further information please contact our pensions advice team on 01628 566446 or email: info@alexcheema.com

Posted on 09.03.2018